Dec/21

Our strategy endeavours to invest in only the most efficient companies. Samco's HexaShield tested framework strictly defines and quantifies the definition of a high-quality business. Our investable universe

Dec/21

Even for the highest quality companies, there will be a valuation at which they are no longer attrac-tive investments which

Dec/21

Many investors are unaware of precisely how much they are being charged for their investment activity, so let’s have a look at the costs the average investor might incur.

Mid Cap companies are the 101st-250th companies in terms of market capitalization. Mid Cap Funds are those equity-oriented funds that invest primarily in mid cap companies.

It is a strategy to invest in stocks which are showing relatively stronger momentum. Momentum stocks are such that exhibit positive price momentum – based on the phenomenon that stocks which have performed well in the past relative to other stocks continue to perform well in the future, and stocks that have performed relatively poorly continue to perform poorly. The momentum strategy aims to buy high, sell higher or alternatively aims to cut your losses and hold on to stocks that are relatively performing better.

Momentum works due to behavior biases of the investors in the financial markets. Investors usually are not always rational, they have limits to their control over their emotions and are influenced by their own biases such as loss aversion, regret, anchoring and disposition biases. Because of all these human biases, there exists a potential opportunity in the momentum space which can be assumed to be more consistent and time-tested strategy to make an alpha in the stock market. However, investors should consult their financial advisor before investing.

Samco Mid Cap Fund uses a cutting-edge momentum-based strategy with SAMCO's proprietary C.A.R.E. Momentum system to deliver superior risk-adjusted returns. It identifies mid cap stocks with strong momentum in Cross Sectional, Absolute, Revenue, and Earnings Momentum. These parameters ensure that the portfolio remains optimized by focusing on mid cap stocks from the companies ranked between 101-250 by market capitalization, as defined by the AMFI, that exhibit robust momentum traits.

Samco Mid Cap Fund uses C.A.R.E Momentum Strategy which invests in mid cap stocks that are showing momentum characteristics in Cross Sectional, Absolute, Revenue, and Earnings Momentum to deliver superior risk-adjusted returns. The fund will invest between 65%-100% of assets in companies between rank 101-250 by market capitalisation, also referred to as Mid Cap companies. The fund also has the flexibility to invest 0-35% of assets in companies other than mid-caps or international stocks or in debt/money market instruments. The scheme may use derivatives instruments for purposes of hedging up to 80% of net assets and shall not exceed 50% of net assets for other than hedging purposes. To know in detail please read the SID.

The minimum investment amount for lumpsum is ₹5,000 and in multiples of ₹1/- thereafter and for Systematic Investment Plan (SIP) During NFO it is ₹250 and in multiples of ₹1/- up to ₹1,000 – 12 installments OR ₹1,000/- and above in multiples of ₹1/ - 6 installments.

The fund will be jointly managed by Mrs. Nirali Bhansali, Mr. Umeshkumar Mehta, Mr. Dhawal Ghanshyam Dhanani and Mrs. Komal Grover.

The benchmark for this scheme is the Nifty Midcap 150 Total Returns Index.

Multi cap funds are those which are required to hold at least 75% of their assets in equity and equity related instruments at any point in time. The portfolio must allocate at least 25% of its assets to large-cap, 25% to mid-cap, and another 25% to small-cap stocks.

Samco Multi Cap Fund is a 4 in 1 equity scheme that invests 25% across Large, Mid, Small caps and small cap companies beyond Nifty 500 with the investment objective of generating long term capital appreciation for investors. This 4-in-1 approach ensures diversified exposure to different market capitalizations.

The Samco Multi Cap Fund employs a proprietary stock selection algorithm focused on identifying stocks demonstrating trending price action and earnings momentum. This careful and dynamic stock selection process ensures the fund captures growth opportunities across different market capitalizations while managing risk effectively.

Samco Multi Cap Fund follows a 4-in-1 approach and maintains flexibility through an adaptive portfolio allocation. In challenging conditions such as bear markets, the fund may increase allocation to large caps for stability, use hedging strategies to mitigate risk, and invest in debt or money market instruments to ensure liquidity and preserve capital. This proactive approach ensures that the portfolio remains resilient and capable of capitalizing on emerging opportunities while minimizing downside risks.

Investors seeking stability of large businesses and at the same time aiming for higher alpha generation may consider Samco Multi Cap Fund.

The Scheme performance would be benchmarked against Nifty Multi Cap 50:25:25 TRI.

Dividends will not be declared by Samco Multi Cap Fund and only growth plan would be available.

Small Cap companies are the 251st-750th companies in terms of market capitalization. Small Cap Funds are those equity-oriented mutual funds that invest primarily in small cap companies.

It is a strategy to invest in winning stocks which are showing strong momentum. Momentum stocks are such that exhibit positive price momentum – based on the phenomenon that stocks which have performed well in the past relative to other stocks (winners) continue to perform well in the future, and stocks that have performed relatively poorly (losers) continue to perform poorly. The momentum strategy is based on buy high, sell higher or alternatively, cut your losses and let your winners run.

Momentum works due to behaviour biases of the investors in the financial markets. Investors are not always rational, they have limits to their control over emotions and are influenced by their own biases such as loss aversion, regret, anchoring and disposition biases. Because of all these human biases, there exists an opportunity in the momentum space which is more consistent and time-tested strategy to make an alpha in the stock market.

Samco Small Cap Fund uses a cutting-edge momentum-based strategy with SAMCO's proprietary C.A.R.E. Momentum system to deliver superior risk-adjusted returns. It identifies small cap stocks with strong momentum in Cross Sectional, Absolute, Revenue, and Earnings Momentum. These parameters ensure that the portfolio remains optimized by focusing on small cap stocks from the companies ranked beyond 250+ by market capitalization, as defined by the AMFI, that exhibit robust momentum traits. The Investment universe of the fund shall primarily be focused on Universe of companies from Market cap Rank 251 – 750. This will allow the fund to also build exposure to small caps beyond the NIFTY500 Universe.

Samco Small Cap Fund uses C.A.R.E Momentum Strategy which invests in small cap stocks that are showing momentum characteristics in Cross Sectional, Absolute, Revenue, and Earnings Momentum to deliver superior risk-adjusted returns. The fund will invest between 65%-100% of assets in companies beyond rank 250+ by market capitalisation, also referred to as Small cap companies. The fund also has the flexibility to invest 0-35% of assets in companies other than small caps or international stocks or in debt/money market instruments. The scheme may use derivatives instruments for purposes of hedging up to 80% of net assets and shall not exceed 50% of net assets for other than hedging purposes.

The minimum investment amount for lumpsum is Rs.5,000 and in multiples of ₹1/- thereafter and for Systematic Investment Plan (SIP) it is Rs. 500 and in multiples of ₹1/- thereafter.

There is no entry load applicable. 10% of units can be redeemed at any time without an exit load. Any redemption in excess of 10% of units will incur 1% exit load in the first 12 months. No exit load, if redeemed after 12 months from the date of allotment of unit.

The fund will be jointly managed by Mrs. Nirali Bhansali, Mr. Umeshkumar Mehta, Mr. Dhawal Ghanshyam Dhanani.

The benchmark for this scheme is the Nifty Smallcap 250 Total Returns Index.

Samco Special Opportunities Fund is an open-ended equity scheme with an investment objective to achieve long-term capital appreciation by investing in a portfolio of securities that are involved in special situations such as restructurings, turnarounds, spin-offs, mergers & acquisitions, new trends, new & emerging sectors, digitization, premiumization, and other special corporate actions which has the potential to create superior long-term risk adjusted returns.

The Samco Special Opportunities Fund employs a unique, proprietary “DISRUPTION” Model to identify investment opportunities. This model is based on 10 distinct sub-strategies (see image below), each designed to uncover special situations within diverse themes. This systematic approach enables the fund to generate a diverse range of investment ideas, leveraging disruption and special situations to seek out potential growth and value for investors.

| Strategy | Catalyst for price appreciation triggered by underlying revenue / profit growth |

|

|---|---|---|

| D | Digitization | Megatrend of Digital adoption |

| I | Insider Mirror Trading | Riding behind actions of Insiders |

| S | Spin Offs & Corporate Actions | Value unlocking due to simplification |

| R | Reforms - Regulatory, Governmental | Accelerated growth & improving efficiencies |

| U | Undervalued Holding Companies | Mean reversion of Holdco discount |

| P | Premiumisation | Rising standards of living of consumers |

| T | Trends sustainable over time | Tailwinds due to behaviour shifts |

| I | Innovation & Technological Disruptions | Product/Channel, etc Innovation |

| O | Organised Shift | Rapid Growth due to unorganized shift |

| N | New & Emerging Sectors | Under-ownership & low discovery |

The Samco Special Opportunities Fund demonstrates dynamic flexibility, crucial for navigating the ever-changing landscape of sectors and themes in the investment world. Its adaptability allows it to swiftly shift focus across diverse areas such as defence, energy, railways, pharmaceuticals, and infrastructure, capitalizing on the best opportunities as they emerge rather than sticking to just one theme. This strategic flexibility ensures that the fund can adapt to and thrive in the fluid nature of market trends, offering a robust advantage to investors seeking diversified exposure and potential growth across varied sector, for compounding their wealth.

The fund is designed to be universe agnostic, meaning it does not limit its investment scope to companies of a specific market capitalization. This strategy allows the fund to explore and capitalize on special situations across the entire market spectrum, from large-cap to micro-cap companies. By not confining itself to a particular segment, the fund is able to pursue a wide range of investment opportunities wherever they may arise, enhancing its potential for capital appreciation by tapping into diverse and sometimes underexplored areas of the market.

Samco Special Opportunities Fund is suitable for investors who are seeking long term capital appreciation through an actively managed thematic equity scheme that invests in stocks based on special situations theme.

Samco Special Opportunities Fund offers five distinct benefits:

For taxation purposes, Samco Special Opportunities Fund is treated as an equity scheme and taxed accordingly.

Short-term capital gains (STCG) tax: If you sell your units within 12 months of purchase, the capital gain will be classified as STCG, and tax will be levied at 15%.

Long-term capital gains (LTCG) tax: If you sell your units after 12 months of purchase, the capital gain will be classified as LTCG. Every financial year, the first Rs. 1 lakh long-term capital gain will be exempt from taxation. The incremental long-term capital gain above Rs.1 lakh will be taxed at 10%.

The Exit Load of Samco Special Opportunities Fund is as under:

There is no restriction on number of stocks in the fund. The scheme will focus on generating long-term capital growth by investing in companies that are experiencing or poised for special situations.

The Scheme performance would be benchmarked against NIFTY 500 TRI.

The fund has no specific target relating to portfolio turnover.

Dividends will not be declared by Samco Special Opportunities Fund and only growth plan would be available.

Large Cap companies are the 1st to 100th company in terms of market capitalization. Large Cap Funds are those equity-oriented mutual funds that invest at least 80% of their funds in large cap companies.

It is a strategy to invest in winning stocks which are showing strong momentum. Momentum stocks are such that exhibit positive price momentum – based on the phenomenon that stocks which have performed well in the past relative to other stocks (winners) continue to perform well in the future, and stocks that have performed relatively poorly (losers) continue to perform poorly. The momentum strategy is based on buy high, sell higher or alternatively, cut your losses and let your winners run.

Momentum works due to behaviour biases of the investors in the financial markets. Investors are not always rational, they have limits to their control over emotions and are influenced by their own biases such as loss aversion, regret, anchoring and disposition biases. Because of all these human biases, there exists an opportunity in the momentum space which is more consistent and time-tested strategy to make an alpha in the stock market.

SAMCO Large Cap Fund uses a cutting-edge momentum-based strategy with SAMCO's proprietary C.A.R.E. Momentum system to deliver superior risk-adjusted returns. It identifies large-cap stocks with strong momentum in Cross Sectional, Absolute, Revenue, and Earnings Momentum. By focusing on the top 100 companies by market capitalization, the fund optimizes the portfolio and mitigates risks using derivatives and hedging during market volatility.

Samco Large Cap Fund uses C.A.R.E Momentum Strategy which invests in large cap stocks that are showing momentum characteristics in Cross Sectional, Absolute, Revenue, and Earnings Momentum to deliver superior risk-adjusted returns. During periods of anti-momentum, net equity exposure could go to 0% using arbitrage and hedging while in periods of momentum Gross and Net Equity exposure could go up to 100%. The scheme may invest up to 100% of its net assets in equity & equity related instruments. The net equity exposure could go to 0% to protect the downside risk. This fund combines an active momentum strategy along with investing in large caps which will generate alpha for investors over the long term

The minimum investment amount for lumpsum is Rs.5,000 and in multiples of ₹1/- thereafter and for Systematic Investment Plan (SIP) it is Rs. 500 and in multiples of ₹1/- thereafter.

There is no entry load applicable. 10% of units can be redeemed without an exit load within 12 months of allotment. Any redemption in excess of such limit in the first 12 months will incur 1% exit load. No exit load, if redeemed or switched out after 12 months from the date of allotment of unit.

The benchmark for this scheme is NIFTY 100 Total Returns Index

It is a thematic fund that invests in stocks that exhibit momentum characteristics and sell those stocks when those stocks lose momentum.

Momentum works dues to behaviour biases of the investors in the financial markets. Investors are not always rational, they have limits to their control over emotions and are influenced by their own biases such as loss aversion, regret, anchoring and disposition biases. Because of all these human biases, there exists an opportunity in the momentum space which is more consistent and time tested strategy to make an alpha in the stock market.

It is a strategy to invest in winning stocks which are showing strong momentum. Momentum stocks are such that exhibit positive price momentum – based on the phenomenon that stocks which have performed well in the past relative to other stocks (winners) continue to perform well in the future, and stocks that have performed relatively poorly (losers) continue to perform poorly. The momentum strategy is based on buy high, sell higher or alternatively, cut your losses and let your winners run.

The scheme shall invest in stocks that exhibit momentum characteristics across market capitalisations i.e. Large Caps, Mid-Caps, Small Caps and Micro Cap companies. The fund intends to benefit from momentum in stock prices from short to medium term time frame. The fund makes trades based on trading signals generated by our intelligent algorithm. This algorithm has been developed by studying years of market data including price, volume, volatility, open interest, breakouts, relative strengths and correlations with appropriate weights on various data points. The Momentum investing is based on that gap in time that exists before mean reversion occurs. Momentum is usually seen in the short- to intermediate-term.

The universe for this fund will be Nifty 750 i.e. Nifty500 stocks and Nifty Micro cap 250 stocks.

There is no restriction on number of stocks in the fund. The scheme will hold stocks that are in momentum as deemed fit by the fund manager.

No, this scheme comes under the Distinctive Patterns Strategies which will have its own framework. This scheme does not heavily rely on quality of financials and has more emphasis on price, volume, breakouts and other technical indicators.

Nifty500 TRI will be the benchmark of the scheme.

Large Cap companies are the 1st-100th company in terms of market capitalization. Mid Cap companies are the 101st-250th company in terms of market capitalization. Large and Mid-Cap Funds are those equity-oriented mutual funds that invest primarily in a mix of large and mid-cap companies.

It is a strategy to invest in winning stocks which are showing strong momentum. Momentum stocks are such that exhibit positive price momentum – based on the phenomenon that stocks which have performed well in the past relative to other stocks (winners) continue to perform well in the future, and stocks that have performed relatively poorly (losers) continue to perform poorly. The momentum strategy is based on buy high, sell higher or alternatively, cut your losses and let your winners run.

Momentum works due to behaviour biases of the investors in the financial markets. Investors are not always rational, they have limits to their control over emotions and are influenced by their own biases such as loss aversion, regret, anchoring and disposition biases. Because of all these human biases, there exists an opportunity in the momentum space which is more consistent and time-tested strategy to make an alpha in the stock market.

SAMCO Large & Mid Cap Fund uses a cutting-edge momentum-based strategy with SAMCO's proprietary C.A.R.E. Momentum system to deliver superior risk-adjusted returns. It identifies large & mid cap stocks with strong momentum in Cross Sectional, Absolute, Revenue, and Earnings Momentum. By focusing on the top 250 companies by market capitalization, the fund optimizes the portfolio and mitigates risks using derivatives and hedging during market volatility.

Samco Large & Mid Cap Fund uses C.A.R.E Momentum Strategy which invests in large and mid-cap stocks that are showing momentum characteristics in Cross Sectional, Absolute, Revenue, and Earnings Momentum to deliver superior risk-adjusted returns. It allocates 35–65% of its assets to large cap stocks (top 100 companies) and 35–65% to mid-cap stocks (ranked 101–250), ensuring diversified exposure across market segments. Additionally, it has the flexibility to invest up to 30% in companies beyond the top 250 companies or in debt/money market instruments. The strategy incorporates derivative instruments for hedging up to 80% of net assets and for other purposes up to 50%, enhancing portfolio stability during volatile market phases.

The minimum investment amount for lumpsum is Rs.5,000 and in multiples of ₹1/- thereafter and for Systematic Investment Plan (SIP) it is Rs. 500 and in multiples of ₹1/- thereafter.

There is no entry load applicable. 10% of units can be redeemed at any time without an exit load. Any redemption in excess of 10% of units will incur 1% exit load in the first 12 months. No exit load, if redeemed after 12 months from the date of allotment of unit.

The fund will be jointly managed by Mrs. Nirali Bhansali and Mr. Umeshkumar Mehta and Mr. Dhawal Ghanshyam Dhanani.

The benchmark for this scheme is the Nifty Large Midcap 250 Total Returns Index.

Samco Flexi Cap Fund is suitable for all investors who want to invest in equity markets for a minimum period of 3 years and are looking to own efficient businesses across the globe.

Samco Flexi Cap Fund's performance would be benchmarked against NIFTY500 TRI. Please understand that the performance of the benchmark is a broad measurement of the changes in the stock markets. It is to be used only for comparative purposes only and in no way indicates the potential performance of the Samco Flexi Cap Fund.

Resident adult individuals either singly or jointly (not exceeding three) or on an Anyone or Survivor basis; 2. Hindu Undivided Family (HUF) through Karta; 3. Minor (as the first and the sole holder only) through a natural guardian (i.e. father or mother, as the case may be) or a court appointed legal guardian. There shall not be any joint holding with minor investments; 4. Partnership Firms including limited liability partnership firms; 5. Proprietorship in the name of the sole proprietor; 6. Companies, Bodies Corporate, Public Sector Undertakings (PSUs), Association of Persons (AOP) or Bodies of Individuals (BOI) and societies registered under the Societies Registration Act, 1860(so long as the purchase of Units is permitted under the respective constitutions); 7. Banks (including Co-operative Banks and Regional Rural Banks) and Financial Institutions; 8. Religious and Charitable Trusts, Wakfs or endowments of private trusts (subject to receipt of necessary approvals as "Public Securities" as required) and Private trusts authorised to invest in mutual fund schemes under their trust deeds; 9. Non-Resident Indians (NRIs) / Persons of Indian origin (PIOs)/ Overseas Citizen of India (OCI) residing abroad on repatriation basis or on non repatriation basis; 10 Foreign Institutional Investors (FIIs) and their sub-accounts registered with SEBI on repatriation basis; 11. Army, Air Force, Navy and other paramilitary units and bodies created by such institutions; 12. Scientific and Industrial Research Organizations; 13. Multilateral Funding Agencies / Bodies Corporate incorporated outside India with the permission of Government of India / RBI; 14. Provident/ Pension/ Gratuity Fund to the extent they are permitted; 15. Other schemes of Samco Mutual Fund or any other mutual fund subject to the conditions and limits prescribed by the SEBI (MF) Regulations; 16. Schemes of Alternative Investment Funds; 17. Trustee, AMC or Sponsor or their associates may subscribe to Units under the Scheme; 18. Qualified Foreign Investor (QFI) 19. Such other person as maybe decided by the AMC from time to time. The list given above is indicative and the applicable laws, if any, as amended from time to time shall supersede the list.

We are only investing in the high-quality efficient businesses and we try to invest in them at an efficient price and hence it is assumed that we will not have to make too many changes in the portfolio

It will have 25 of the best businesses across the globe with at least 65% of businesses from India and 35% from across the globe.

It is simple 3-step strategy that we follow at the fund level -

Voluntary dealing cost is something that is deducted from the NAV and occurs due to excessive turnover or changes in the portfolio of the fund. Samco Flexi Cap aims at keeping this cost to a minimum by reducing the change in the portfolio

The Foreign Account Tax Compliance Act (FATCA) is a United States Federal Law, aimed at prevention of tax evasion by United States taxpayers through use of offshore accounts. The provisions of FATCA essentially provide for 30% withholding tax on US source payments made to Foreign Financial Institutions unless they enter into an agreement with the Internal Revenue Service (US IRS) to provide information about accounts held with them by USA persons or entities (firms/companies/trusts) controlled by USA persons.

Equity Linked Saving Scheme (ELSS), also known as tax-saver fund, is an open ended Equity mutual fund scheme that invest primary in equity related products. However, these ELSS mutual funds have a three-year mandatory lock in term, which is the shortest lock in period if compared to all other products that are available under Section 80C of the Income Tax Act, 1961.

Investors who wish to invest for a minimum of 3 years and are looking for higher return potential, plus the added benefit to save tax under section 80C can invest in ELSS Tax Saver Fund. At the same time, the investors should also prepare for a certain amount of risk attached to it. This is because of the equity exposure in the portfolio. Therefore, ELSS mutual funds are best suited for investors who understand equity asset class risk. These tax saver funds offer higher returns potential when compared to other tax saving schemes.

The following are the critical factors that must be considered by investors before they invest in ELSS Tax saver fund:

Yes, ELSS has a lock-in period of three years. This means one cannot withdraw their money before the said tenure ends. However, ELSS has the shortest lock-in period as compared to other similar tax-saving investments currently such as 5-year Fixed Deposits (five years), National Savings Certificate (five years), Public Provident Fund (15 years), etc.

The redemption proceeds of ELSS are not entirely tax-free. The long-term capital gains of up to Rs 1,00,000 a year are tax-free, and any gains above this limit attract a long-term capital gains tax at the rate of 10% plus applicable cess and surcharge.

The investment objective of the scheme is to generate long-term capital appreciation through investments made predominantly in equity and equity related instruments. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

The Fund's strategy will endeavor to have a predominantly higher allocation to mid and small cap companies which will be selected through focusing on the fundamentals of the business, the industry structure, the quality of management, sensitivity to economic factors, the financial strength of the company and the key earnings drivers. The scheme will invest in about 30-40 scripts to ensure adequate diversification and reduced risk.

The following persons (subject to, wherever relevant, purchase of Units of mutual funds, being permitted under respective constitutions, and relevant statutory regulations) are eligible and may apply for Subscription to the Units of the Scheme:

The above list of persons in category 4 to 18 are not eligible for tax benefits under Section 80 C of the Income-tax Act, 1961 but are entitled to subscribe to units.

The minimum amount for application for an investor will be Rs. 500.

There is Nil entry/exit load on Samco ELSS Tax Saver Fund.

The Scheme performance would be benchmarked against Nifty 500 TRI

The investors can choose their preferred mode of payment, such as UPI, IMPS, NEFT, RTGS, or Cheques. If an investor opts to use UPI for the payment to registered intermediaries, then they have to do so only using the new UPI IDs allotted to registered intermediaries. To know more refer SEBI circular

No, the new UPI IDs are only for intermediaries to obtain, and investors can continue to use their existing UPI IDs.

The secure validated UPI ID of intermediaries will use the same banking channel as the earlier generic UPI handles. In case of any technical difficulty, investors are requested to approach their respective bank.

It is a proprietary framework using AI / ML technology that tests 6 important factors of businesses under various situations. It is not just a back-testing mechanism, but also does scenario analysis to see how a business would do under extreme pressure.

All manufactured products go through thorough quality tests before they ever reach the customers. We are the first fund house to apply the same level of quality testing to our investment processes so that our investor’s money is invested in the high quality efficient companies

They broadly exhibit two attributes -

We have analysed over 67,000 global companies and out of these companies only ~125 companies pass the HexaShield testing framework.

SAMCO’s Timer Systematic Transfer Plan (TimerSTP / TSTP) is a solution wherein unit holder(s) can choose to transfer variable amount(s) from ‘Source Scheme’ to the ‘Target Equity Scheme’ at pre-defined intervals. TimerSTP will invest more when the markets are attractive and below their intrinsic value, similarly invest less when the markets are high and expensive. The amount(s) of transfer to the Target Scheme will be linked to the Equity Margin of Safety Index (EMOSI) as computed by the AMC on the date of respective transfer.

An investor must maintain minimum balance/ investment of Rs. 25,000/- in the opted source scheme at the time of registration of TimerSTP.

The Base Installment Amount is the installment amount that is mentioned while registering for TimerSTP. Minimum base instalment amount is Rs 1000 and in multiples of Re 1, but this is bare minimum amount, however it is recommended to mention base installment as 1/12 of the total amount to be transferred to the Target Equity Scheme. The processing of installment amount will be based on opted date/ day of multiplier of EMOSI value in case the base computation amount is less than Rs. 100, then the installment will be considered as Rs. 100. If arrived amount is in decimals the same will be rounding off in nearest rupee. For example, if an investor has invested Rs. 120,000 in source scheme, he can mention Rs. 10,000 (1/12 of target investment in the Equity Scheme) as base installment for monthly frequency of TimerSTP.

The Multiplier is the “Number of Times” of the installment amount to be transferred to target equity scheme. It will be within the range of “0.01X” to “6X” of the base installment. For example, If Investor registered TimerSTP with the base installment of Rs. 10,000, the multiplier amount can be from Rs. 100 (0.01X multiplier) to Rs. 60,000 (6X multiplier).

The amount of transfer to the target equity scheme is based on the latest Equity Margin of Safety Index (EMOSI) levels which is a proprietary model of Samco Asset Management Pvt Limited (the AMC). However, in any case the TimerSTP instalment amount will not exceed 6x of the base instalment amount as per the multiplier selected.

Equity Margin of Safety Index (EMOSI) levels computed by the AMC is a proprietary model of Samco Asset Management Pvt Limited (the AMC). The EMOSI is derived by assigning different weights such as Price to Earnings (PE), G-sec yields, moving average divergences and / or other fundamental and technical factors as may be determined by the AMC from time to time.

The investors have option of Weekly, Monthly and Quarterly frequency for transfer of funds from the eligible source schemes to eligible target equity schemes.

In such a case the TimerSTP will be registered (the default) till December 31, 2099.

(An open-ended dynamic equity scheme investing across large cap, mid cap, small cap stocks)

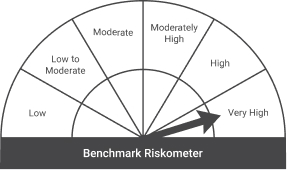

This product is suitable for investors who are seeking* :

**Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors understand that their principal willbe at very high risk

Mutual fund investments are subject to market risks, read all scheme related documents carefully.