Buying Efficient Companies

The 1st Leg of the 3E strategy is Buying efficient companies

Our strategy endeavours to invest in only the most efficient HexaShiled-tested companies. Samco's HexaShield-tested framework strictly defines and quantifies the definition of a high-quality business. Our investable universe is restricted to a limited set of ~125 businesses from India and the Globe that pass our stringent quality tests and we will construct a portfolio of 25 stocks from this universe.

What is an efficient HexaShield-tested company?

A company that has the ability to sustainably generate a high return on capital in cash adjusted for discretionary growth expenditures. We typically seek businesses that make a 25% + adjusted return on capital.

Let’s break this down:

A. We are seeking a high return on capital business that generates its returns in cash and on an un-levered basis

If you invest in a fixed deposit, you want to know the rate of interest, If you own a bond, you want to know the redemption yield. If you invest in a fund, you want to know what sort of returns it can deliver. The same is applicable while evaluating a company as well where you ought to know what returns it makes on the capital employed.

Additionally, if you own shares for long periods of time, the returns they deliver will move towards the company’s return on capital. This is a simple mathematical equation as we will explain in subsequent sections.

Also, it's important for the business to generate most of its return in the form of free cash because if there's no cash, how does one even judge if the return is real or not? Companies can do all sorts of accounting gimmickry to demonstrate an accounting return on capital but unless we see that in

cash, it's a pass for us.

It's also important that companies earn a high return on their capital on an unleveraged basis. Companies that need a disproportionate amount of debt to generate returns, usually end up having stressed balance sheets with no room for error and consequently, extremely high risk. Companies that form a part of our portfolios survive our quality tests with excellent scores. These businesses

can function without debt as well and are likely to have no impact even if lines of credit were withdrawn at any time. Companies such as Microsoft, Hindustan Unilever, and Nestle have excellent balance sheet strength and will remain solvent even in extremely stressful situations. On the other hand, a lot of companies in the telecom, utilities, textiles, metals, aviation space amongst others have balance sheets that are barely solvent and any exogenous shock puts them on the brink of

bankruptcy.

B. We are seeking businesses that make investments for growth and therefore

we look at the adjusted return on capital employed

Traditional accounting return on capital employed ignores one important aspect. Very often, a lot of revenue expenditures that are made through the P&L are actually of a capital expenditure nature.

These usually are R&D expenses, discretionary advertising, promotional expenses, and even salaries paid to technology teams like developers. Usually, these expenses are incurred and debited to the P&L Income statement, however, these outflows are made for building intangible assets.

Now, we wouldn't want to penalise companies for investing in R&D and building their brand right? Let's take an example. In recently reported annual earnings, Facebook (now Meta platforms) reported a net income of $ 29.14 billion. However, it also incurred R&D expenses of $ 18.44 billion dollars in the same period. These R&D expenses were incurred for building long-term intangible assets and solidifying Facebook's dominant position. Now we wouldn't want to penalise Facebook for building these assets right? We, therefore, rely on a metric we call the adjusted return on capital employed.

We estimate the amount of these expenses that are essential of capital nature, we notionally capitalise them, apply an amortisation factor and adjust earnings to derive the adjusted return on capital employed. So, even while companies may appear to be losing money basis traditional accounting methodology, their core business generates a ton of free cash flow which is re-invested for R&D or

brand building. These kinds of businesses do pass our quality tests and form a part of our investible universe.

Our process clearly implies and demonstrates that we are looking for companies with growth potential.

We firmly believe that the holy grail in investing is companies not only being able to generate a high return on capital but also having a high re-investment rate at an incrementally similar or higher ROCE. What this means is, while we are happy that our companies may generate Rs. 25 on every Rs. 100 invested, we also want our companies to retain a large part of these earnings (ideally 100% of 25)

and generate a 25% return in the following year on an invested capital base at Rs. 125 i.e. generate Rs. 31.25 in earnings the next year. Over time, this should compound shareholders’ wealth by generating more than a rupee of stock market value for each rupee reinvested.

It's pretty obvious from the above, unlike most investors, we absolutely hate it when our companies declare dividends instead of reinvesting earnings back into the business.

This does not mean growth at any cost. The growth must be profitable of course, generating high returns on the additional capital invested into the business to enable this growth.

The growth that we look for is achieved through either increase in volume or increases in price. We prefer a mixture of both. The ability to increase product prices above the rate of inflation is the most profitable way to grow and communicates to us that the company has a healthy competitive position

selling products or services which are strongly desired by their customers. However, growth through price increases alone can result in undesired competition for weaker players or the unorganised sector as well.

On the other hand, growth through additional unit volumes almost always requires more cost, in manufacturing capacity, the volume of materials used to produce the products, as well as distribution to customers. But increasing scale in this way will eventually make your market position more difficult to compete against, unlike growing through price alone, with a further benefit that volume growth can sometimes continue almost indefinitely. Several companies operating in the consumer space such as Colgate, Castrol have high returns on capital but usually, fail growth and re-investment tests due to their inability to grow volumes in already well-penetrated markets.

Usually the source of growth and large re-investment opportunities that we seek come from playing out trends/themes such as - new product & category development, globalisation of local products or services, under-penetrated consumption of essential goods/services, Ageing population, the urbanisation of rural markets, shift to premiumization, etc.

C. We are looking for businesses that can sustain their returns on capital across

cycles

It is important to note that we are not just looking for a high rate of return on capital. We are seeking a sustainably high rate of return which means we would like our businesses to sustain these returns across cycles and time periods.

What contributes to the sustainability of these high returns?

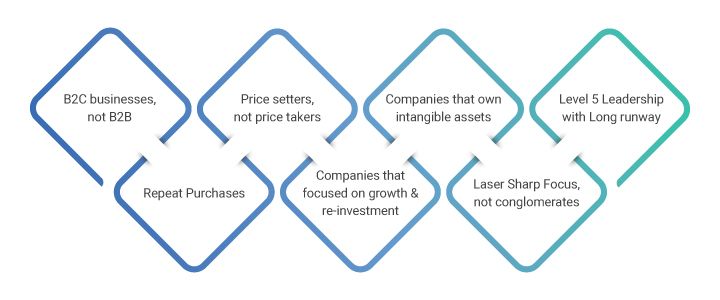

i. Repeat purchases from consumers

An important contributor to sustainable returns is repeated business from consumers. A company that sells many small items each day is better able to earn more consistent returns over the years than a company whose business is cyclical, like a steel manufacturer, or “lumpy”, as a property developer.

Even business services companies may have a source of consistent repeat business, and some capital goods companies like elevator manufacturers (Eg. Kone, etc) earn much of their revenue, and sometimes more than all their profits, from the provision of servicing and spare parts to their the installed base of equipment. These companies very well clear our quality tests.

ii. Essential nature of products or services

The source of high sustainable returns is the fact that consumers feel the need to consume products or services even in tough times due to their essential nature. This is why we don't prefer companies with products/services that have a life that can be extended. When consumers hit hard times, they can defer replacing their cars, houses, and appliances, but not food and toiletries. You could always defer buying a car from Maruti or buying a home from Godrej Properties, but if you

need to take a blood test, you cannot defer the same and would have to go to a Dr. Lal Pathlabs or a Metropolis without much choice.

This rules out most businesses that do not sell directly to consumers or which make goods that are not consumed at short and regular intervals. Capital goods companies sell to businesses; business buyers are able to defer purchases of such products when the business cycle turns down. Moreover, business buyers employ staff whose sole reason is to drive down the cost of purchase and

lengthen their payment terms.

However, not all companies which sell capital goods or which sell to businesses are outside our investible universe as we discussed cases of services companies or capital goods companies with installed bases as above.

iii. Intangible Asset base

There are 2 types of businesses in the world. One where returns on capital are subject to the law of mean reversion and the other where they are not. The law of mean reversion states that returns must revert to the average as new capital is attracted to business activities earning super-normal

returns.

Companies that have sustainably high returns can do this because their most important assets are Intangible assets which can be very difficult to replicate, no matter how much capital a competitor is willing to spend. These companies do not over-rely on physical assets, which can be replicated by anyone with access to capital. Moreover, it’s hard for companies to replicate these intangible

assets using borrowed funds, as banks tend to favour businesses with tangible assets. This means that the business does not suffer from economically irrational (or at least innumerate) competitors when credit is freely available.

The kind of intangible assets we seek are brand names* (Asian Paints & Pidilite in consumer durables), dominant market share (alphabet in search advertising), patents, distribution networks (Bajaj Finserv/ Bajaj Finance), installed bases (Kone), and client relationships (Workday, Microsoft, TCS, etc). Some combination of such intangibles defines a company’s franchise.

iv. Management with a long runway

One of the most important sources of long-term sustainable returns is management having the ability and freedom to operate for long periods of time. We are often amused when CEO contracts/terms run out at the end of 3 years or 5 years. How do you expect a CEO with a mere 3-5 year vision to make long term decisions that will impact the outcome of the company in 10-15-20 years

from now?

This approach rules out most organisations where leadership appointments are made not based on merit but based on some random bureaucratic process.

Disclaimer: The views expressed herein are subject to change based on market and other conditions.

v. Laser-sharp focus & no conglomerate structures

It's important for the businesses that we invest in to be laser-sharp focused on the products and services that they build and the business segments that they operate in. It is important that the organisations not only know what they can be best in the world at but also know what they cannot be best in the world at. The idea is to find the competency at which you can truly be the best in the world and then discard any other competencies. There are only a few things that businesses can be best at and we prefer our companies to stick to their core business competency. Only when the companies indulge in things that they are best at and really passionate about, can they produce results that exceed expectations that we set.

Natural extensions to product segments are fine but we definitely are not fans of unrelated diversification. This rules out conglomerates engaged in every business. How often can you be the best at and passionate if you are in the steel, cement, oil & gas, telecom, and retail business at the same time?

What will not form a part of the portfolio?

As a result of our stringent investible universe, a lot of sectors/themes/stories may not form a part of our portfolio. These may include PSU companies, cyclical businesses, short-term investment fads relying on the greater fool theory, capital intensive social sectors like power, etc.

What will not form a part of the portfolio?

One of the most fundamental reasons why we will avoid these are due to what we call the 50/80 rule. The 50/80 rule implies that there is a 50% chance that stock prices of these companies will fall by 80% and there is an 80% chance that stock prices will fall 50%. We typically are trying to avoid such businesses with such deep drawdowns for the simple reason, that the deeper the drawdown,

the harder is the road to recovery.

Visit our Knowledge Center for more articles on Samco Mutual Funds. You can also find many valuable blogs in our Help and Support section.