E3 Strategy to Create Wealth with Samco Flexi Cap Fund

What can an entrepreneur do to increase the profitability of the business?

In our view, there are two most feasible and obvious things that an entrepreneur can try and attain:

- Increase the sales, and or

- Reduce the expenses

Everything else being constant, if a company can increase its sale, then it could generate higher profitability. Besides this, the company may even try and reduce its expenses to increase profitability. So, if the owner can carry out either of these two things, the profitability of the business would be eventually improved.

Akin to an entrepreneur, a fund manager in order to generate alpha from its portfolio can strategize in a similar fashion.

In this article, we will reveal a strategy which we have implemented in our Samco Flexi Cap Fund in order to create wealth for our investors.We call it the E3 Strategy. In this strategy, we focus on three most important things namely: Buy Efficient HexaShield tested Companies, Buy them at an Efficient Price and Maintain an Efficient Portfolio Turnover. The first two strategy helps us to maximize returns for the investor in the long run and the last one emphasis on keeping the cost as low as possible. We believe these three things have maximum impact on the ultimate returns an investor gets.

The E3 Strategy

1. Buy HexaShield Tested Efficient Companies

Samco Flexi Cap Fund is the first mutual fund in India to introduce the concept of HexaShield tested investing. Central bankers around the world have this concept of HexaShield testing banks’ balance sheets in order to inspect if they can survive in a difficult/ stressful situations and not wither away.

Similarly, we run these HexaShield tests on companies to examine whether they can survive in difficult times or not. We put over 67,000 companies from across the world through our HexaShield test and only 125-odd companies have managed to clear this stringent HexaShield test. Out of these 125 companies, around 40 are Indian companies and 85 are global companies.

If you want to know more about HexaShield tested investing then you can read this article. Here we have detailed the six facets of HexaShield tested investing which is run on those 67,000+ companies.

The companies that clear these HexaShield tests are efficient companies. Such companies sustainably generate an above average return on capital employed (ROCE) in cash for long enough time. We adjust ROCE for discretionary growth-oriented expense like R&D expenses, discretionary advertising and promotional expenses and technology development costs. These efficient companies typically make more than 25% adjusted ROCE.

We believe that the holy grail of investing is investing in companies that can sustainably generate a high ROCE and have a high re-investment rate at an incrementally similar or higher ROCE.

This means that we are looking for companies that generate Rs. 25 or more on every Rs. 100 invested in its business. Not only this… we also want those companies to retain a large part of this Rs. 25 and reinvest it in the business at similar or higher ROCE.

So that it could generate a 25% return on the total invested capital base of Rs. 125. This means that it will generate Rs. 31.25 in earnings (25% of Rs. 125) the next year.

And over time, this would compound shareholders wealth.

Here are examples of some efficient companies...

Being an efficient company doesn’t mean we will buy them immediately. There is one more aspect too that we would consider before buying a business.

We understand that companies that clear our HexaShield tests will typically trade at premium valuations. And we are willing to pay a premium for buying these HexaShield tested efficient businesses but we ensure that we don’t pay an exorbitant premium.

We believe in growth at a reasonable price rather than buying at any price. Hence, we use a metric to identify businesses trading at an efficient price. It is the adjusted free cash flow yield.

Few adjustments are made in the free cash flow to equity shareholders by adding discretionary growth-oriented expenses like R&D expenses, discretionary advertising and promotional expenses and technology development costs which typically managed to create an intangible asset for the business.

We compare this adjusted free cash flow as a percentage of the company’s market capitalization. We compare the yields across listed peers both local and global. Not only this, we even compare it with other assets like bonds and buy only when the relative free cash flow yield of the company is reasonable when compared to others/ peers.

The job of fund manager isn’t over by buying companies at an efficient price. There one more thing that must be focused upon which is nothing but reducing the total cost of investment of the fund.

3. Maintain Efficient Churn and Cost Structure

It is a fiduciary duty of a fund manager to ensure that the total cost of expenses should not eat away the returns made for investors.

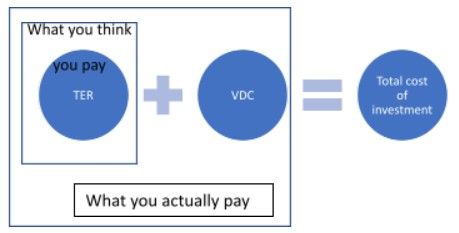

There is a myth in the mutual fund industry that the applicable total expense ratio (TER) is the only cost the unitholder pay for the mutual fund. However, the reality is far different from it. There are a few hidden costs too which no fund houses have disclosed until now.

When a fund manager buys or sells a stock, he pays brokerage, STT, GST and stamp duty too. These costs aren’t included in total expenses ratio. These expenses are straight away deducted from the net asset value (NAV) of the fund and investor is unaware of these costs.

Shocking, isn’t it?

These are known voluntary dealing costs (VDC). These are costs incurred by fund managers at the time of buying and selling shares. It excludes the costs incurred for involuntary transactions such as fund inflows or outflows.

Our research suggests that hyperactive fund managers pay 1.4% in VDC each year over and above the TER.

Given that VDC is charged separately, it reduces and impacts your NAV to that extent. SAMCO Mutual Fund believes in keeping the VDC as low as possible. Given that we buy efficient companies at efficient prices and stick with them for a long time, this would help us to reduce churn and dealing costs which will eventually benefit our investors.

Samco Mutual Fund will transparently disclose all voluntary dealing costs to ensure that we practice what we preach and offer what we claim.

Samco Mutual Fund will be the first mutual fund house in India that will transparently disclose all voluntary dealing costs. It is computed as a percentage of assets under management (AUM).

So this is how we would use the E3 strategy which would help us to generate superior returns for our investors.

Do share your thoughts and feedback on this strategy in the comment section below!

Visit our Knowledge Center for more articles on Samco Mutual Funds. You can also find many valuable blogs in our Help and Support section.