HexaShield - Samco Mutual Fund’s

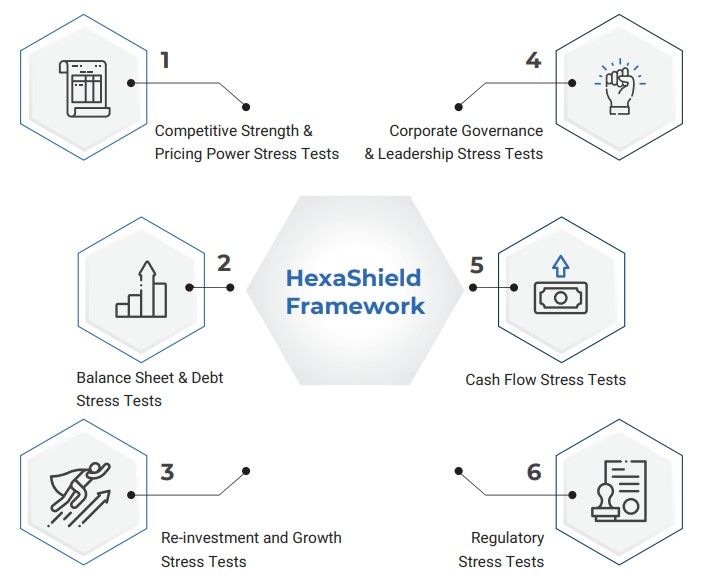

A Closer look at the HexaShield framework that is used to evaluate HexaShield tested companies:

1. Competitive and Pricing Power Tests

2. Balance Sheet and Insolvency Tests

3. Re-investment and Growth Tests

4. Corporate Governance and Leadership Tests

5. Cash Flow Tests

6. Regulatory Tests

1. Competitive and Pricing Power Tests

The competitive advantage or moat of the company is one of the most important factors that determine whether a business will be able to generate a high rate of return. Competitive and pricing power tests in the HexaShield framework are designed to test the impact on the business in extremely competitive situations. Companies that pass the test on these parameters are the ones that usually have a reasonably high pricing power due to the nature of goods and services that they produce. This pricing power usually comes from the fact that there is an intangible component in the products or services provided which makes it difficult for the business to be completely commoditised. It also is a function of whether a business is built on a business-to-consumer model or a business-to-business model. Business buyers employ staff whose soleraison d’être is to drive down the cost of purchase which significantly diminishes the ability of the business to protect margins and consequently a reasonable rate of return.

The competitive strength and ability to pass the test is evaluated in a range:

Monopolistic Competitive & Pricing Strength: These businesses have extremely high competitive strength. They can protect margins and pass on all cost increases to customers without significant impact. Their competitive advantage is so strong that they emerge extremely resilient even if they are put through the extreme competitive test.

High Competitive & Pricing Strength: These businesses have high competitive strength. Their competitive advantage is reasonably strong and they operate businesses that are able to generate above-average returns even as competitive intensity increases.

Reasonable Competitive & Pricing Strength: These businesses have reasonable competitive strength. Their competitive advantage is moderately strong and meets benchmark returns even if the competitive intensity increases.

Low Competitive & Pricing Strength: These businesses are nearly commodity plays with minor differentiations. While they may survive in a competitive environment, they usually fail to build a sustainable compounding machine in a highly competitive environment.

No Competitive & Pricing Strength: These businesses are commodity players and usually price takers and usually fail to survive and also can't be sustainable compounding machines in a highly competitive environment.

Companies such as Info Edge operate Naukri.com and exchange platforms such as IEX or MCX typically have extremely strong competitive strength and pricing power. This usually is also a function of the two-way network effects that have been built by these companies. Companies with reasonable pricing power are those where there is a lot of competitive intensity but an intangible moat such as brand recall, distribution network, etc allows them to charge a premium and protect margins the test. Businesses like Dominos Pizza, Asian Paints, etc fall in this category. On the bottom end of the spectrum are pure commodity plays such as cement, steel, or aluminum companies which are typically price takers of prevailing prices in global markets.

2. Balance Sheet and Insolvency Tests

Balance sheet and insolvency tests evaluate the impact of various shocks to an organisation's balance sheet. It helps figure out whether the company has enough capital to survive stressful conditions and still remain solvent. A strong balance sheet usually results in a lower cost of capital which in turn becomes a massive driver of value creation. Companies that need a disproportionate amount of debt to generate returns, usually end up having stressed balance sheets with no room for error and consequently, extremely high risk. Companies need to be put through these tests with cognisance to the fact that lines of credit can be withdrawn at any time, often with disastrous consequences given the illiquidity of certain companies' asset bases.

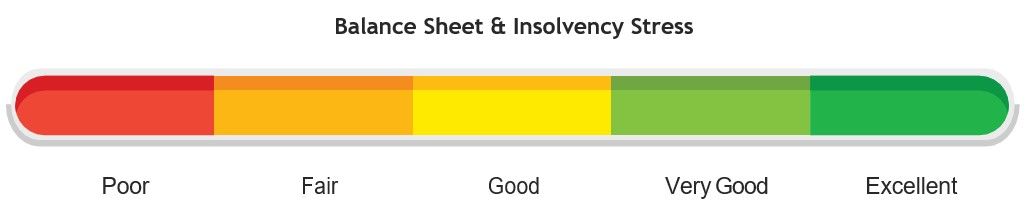

The balance sheet and solvency strength are evaluated in a range as:

Excellent: These businesses have strong balance sheets and practically zero debt balance sheet or insolvency test. These are unlikely to go bankrupt even in extremely stressful situations due to the lack of leverage as well as the relatively highly liquid nature of the asset base.

Very Good: These businesses have very good balance sheets with relatively negligible leverage. This results in above-average capital adequacy and solvency even in stressful situations.

Good: These businesses have good balance sheets where capital adequacy and solvency meet benchmarks when put through the test.

Fair: These businesses have good balance sheets but need a high amount of leverage to generate a reasonable return. Further, while they generally make a reasonable return, when put through a test, they end up failing and falling short on capital adequacy and solvency benchmarks.

Poor: These businesses have terrible balance sheets staring down the barrel of death by debt.

Companies such as Microsoft, Hindustan Unilever, or Nestle have excellent balance sheet strength and will remain solvent even in extremely stressful situations. On the other hand, a lot of companies in the telecom, utilities, textiles, metals, aviation space amongst others have balance sheets that are barely solvent and any exogenous shock puts them on the brink of bankruptcy.

3. Re-investment and Growth Tests

When the growth goes away, equities become bonds because when the growth is zero, the returns expected are merely the interest rates (earnings divided by market value)and not really the compounding. If growth goes away perpetually, then businesses cannot really quote higher than the net worth and when the outlook deteriorates further and turns negative, it will quote at a discount to the net worth. In other words, when the growth is away, the stocks become bonds. Growth is the key glue that allows the firm value to be much higher than the net worth or the value to have the power to reflect a strong multiple of the profits rather than being treated as a limited life concern. When growth is there, equities are treated as a going concern, and when the growth goes away, equities are treated as bonds or bonds minus.

For creating outstanding value through investing, one of the most important foundations is earnings and its growth. It is narrated ad infinitum that price is nothing but a slave of earnings and its relentless growth over a period of time. If earnings are real and in cash and if they keep growing, then that will definitely reflectin the price and the sustainability of earnings growth into the market cap compounding. Re-investment and growth tests evaluate the impact of recession or depression on earnings and consequently the return on capital. They also test the impact on the overall return on capital employed if incremental deployment of capital happens at lower rates which usually happens due to lack of market size or opportunity.

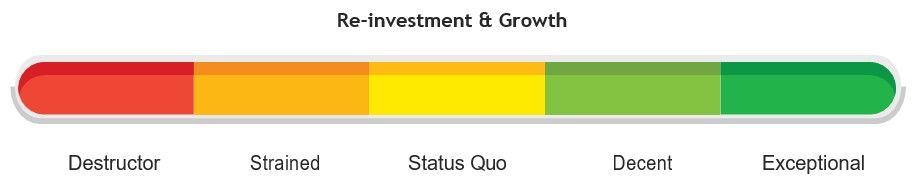

The outcome of re-investment and growth tests are evaluated in a range as:

Exceptional: These businesses generate above-average returns when put through tests of negative growth environments and have a huge size of the opportunity to re-invest at an above-average incremental return on capital.

Decent: These businesses generate above-average returns when put through tests of negative growth environment however have a limited opportunity to re-invest capital and grow which reduces compounding capability.

Status Quo: These businesses generate average returns when put through tests of negative growth environment but have little to no opportunity to re-invest capital and grow. This reduces them to bond-like businesses.

Strained: These businesses struggle to consistently grow in normal situations and end up being value destroyers when put through tests.

Destructor: These are the worst quality businesses and end up being massive value destroyers across cycles.

Several companies operating in the consumer space such as Colgate, Castrolhave high returns on capital but usually fail growth and re-investment tests. Companies that usually do well in these are ones that have a very large market opportunity (usually global) or are operating in a severely under-penetrated category. Companies in the retail space such as Avenues Supermart or in retail financing space score well on growth tests due to the size of the opportunity. Companies that spend money in R&D that usually end up creating new categories do very well. One such example is that of Microsoft which used cashflows from the Microsoft Office licensing business to build a very large cloud business. Similar was the case in Facebook which used cashflows from the Facebook platform to acquire multiple businesses such as Instagram and WhatsApp to continue to expand its market opportunity.

4. Corporate Governance and Leadership Tests

Leadership quality and quality of governance have a far bigger impact on real returns than most people care to understand. Management quality is not as inscrutable or undecipherable, as is generally believed. It is a real factor, with a real impact on the value of a firm, and can be quantitively evaluated with analysis of capital allocation and capital distribution decisions. The corporate governance and leadership tests consider stress at granular levels which includes stress at promoter levels, board independence, accounting practices, conglomerate complexity, promoter pledges, etc. The results are then aggregated to give a firm-wide view of the impact on a company's survival ability and compounding capabilities.

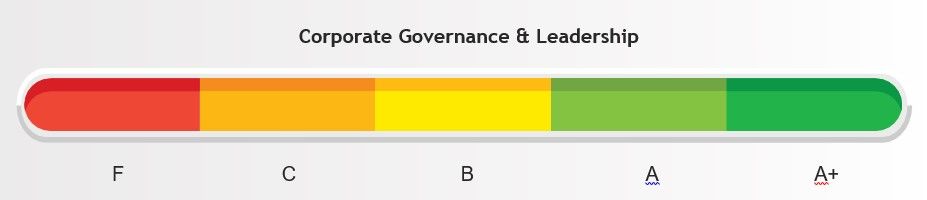

The outcome of governance and leadership tests are evaluated in a range as:

A+: These are outstanding companies with truly independent boards and with a large number of high-quality professionals/promoters running the business. This often reduces continuity and key man risks to a business.

A: Good companies with good management and reasonably independent boards but subject to high control from a specific group of persons.

B: Governance standards and leadership meet benchmarks.

C: While optically governance standards and management quality meet benchmark compliance requirements, there is a firm wide failure when put through tests.

F: Poor quality of governance with no protection for minority investors.

Businesses such as Infosys or HDFC Bank are businesses with truly independent boards. The number of independent directors on board actually far exceeds the number of executive/promoter directors. This implies that independent directors usually have much stronger voting power to truly protect the interest of the minority shareholders. At the same time, the pedigree of independent directors is also important which can be judged from current and past Independent directorships in other companies. In family-owned businesses, independent directors usually are on board to meet compliance requirements but lack true independence to protect minority shareholder interest. Also, several businesses have a key man risk since they are overly dependent on the leadership of one key individual. Such businesses usually fail the tests because any adversity to the leader could actually bring down the entire organisation and completely destroy shareholder value. Businesses such as TCS, Dabur, Hindustan Unilever score very well on these tests because they have a large talent resource pool and organisational success is not dependent on one individual. On the contrary, these businesses have built CEO factories for their internal leadership to continually step up.

5. Cash Flow Tests

Cash Flow is the only enduring reality and economic value creation is closely related to the cash flows generated over the useful life of a business. Cash flow tests help evaluate the ability of the company to convert its operating profits into cash when put through shocks. The cash flow tests will determine what is the incremental capital that is needed in stressful times and whether a business already has the required reserve capital and if not, will the capital be available to the business in an economically stressful environment and also at a reasonable cost of capital. These ultimately are critical in the overall equation of the business to survive and create value.

The outcome of Cash flow tests is evaluated in a range as:

Very Strong: These businesses have a very strong cash position and also a very strong cash conversion cycle and have a negligible impact when put through cash suffocation tests.

Strong: Strong companies have a good cash position and an above-average cash conversion cycle and have a slight impact when put through cash suffocation tests.

Adequate: These companies have just adequate cash and an average cash conversion cycle and have a moderate impact on capital requirements and returns when putting through cash suffocation tests.

Stretched: These companies while solvent has huge liquidity constraints and are stretched for cash. There is a large adverse impact on capital requirements and returns when putting through cash suffocation tests.

Starved: These are businesses literally starved for cash operating from end to end. Any stress on the cash positions exponentially increases the probability of an insolvency outcome.

6. Regulatory Tests

Regulations have a sizeable impact on businesses and high regulatory intervention or frequent changes in regulatory impositions can change the course of a business strategy overnight. Hence, regulations in some industries pose as impediments to the growth of a business rather than act as drivers of the expansion. There is a fine line between regulations acting as entry barriers to a business or dampening a company’s growth and understanding this difference is essential to judge if a business will have the freedom to compound its cash flows or go down the path of liquidation. Regulatory tests help evaluate the impact of adverse regulatory actions on a business’ earnings power and balance sheet position and consequently its impact on value creation.

The outcome of Regulatory tests is evaluated in a range as:

Resilient: Businesses are relatively insulated and regulations have relatively low impact. In fact, regulations act as an entry barrier for competition and strengthen the position of the incumbent.

Supportive: The impact of regulations is moderately supportive for business growth.

Accommodative: Despite a tough regulatory regime, there is an accommodative stance for businesses to grow.

Restrictive: Increasing regulatory tightness usually becomes restrictive for growth either due to impact on earnings power or due to increased capital requirements to comply with a tightening regime.

Prohibitory: Regulatory position is prohibitory for business and can be a catalyst for value destruction due to misalignment of regulators and business interests.

Highly regulated businesses where regulators are focussed on curbing demand or prohibiting consumption such as cigarettes, liquor usually score poorly on these tests. On the other hand in businesses like banking, asset management, insurance, etc where entry barriers are high which restrict competition amongst incumbents and the regulator is focused on growing demand, there is a huge opportunity to create wealth for shareholders.

Related Articles:

Maintaining Efficient Portfolio Turnover

Buying Efficient Companies

HexaShield Tested Investing - Introduction

How does HexaShield Tested Investing work?

Visit our Knowledge Center for more articles on Samco Mutual Funds. You can also find many valuable blogs in our Help and Support section.