Things to Know for Wealth Creation

Each and every human being on this planet is carrying a dream with them, and when we dream we make sure it's big. Like buying a luxury car, a sea facing apartment in Mumbai, a beach house in Miami, or buying a ticket to Mars.

But it's impossible to achieve your dreams without having a good wealth creation strategy. In order to start your wealth creation journey, you have to start following these few important guidelines which will help you achieve your wealth creation goals.

1. Find the Right Motivation For Wealth Creation

If your motivation is to create wealth just for the sake of being rich, then this may not help you be motivated throughout your journey. If your wealth creating journey is not backed by a solid goal, dream, or motivation then you will not be able to survive for the long-term. Remember, a goal without a plan is just a dream.

You will only be able to create wealth, when you interconnect your journey with your goals and dreams. This will give you the right mind set and the urge to achieve long-term wealth.

You will be able to focus on your wealth creation journey only if you have a bullseye to hit. For example, a bullseye can represent anything like saving up for your retirement in the next 25 years, buying a dream house for your parents after 10 years, etc.

These motivations help you stay on track to achieve your wealth creation journey and overcome all the obstacles which life throws at you.

Related Article: Small Cap Funds – Benefits, Performance, and more

2. Investments Need Sufficient Time To Grow

No matter how much planning, research, and analysis you put in, if you keep delaying your investments, it will gravely affect your own future. No one investment will make you a millionaire within a day. All investments need sufficient time to grow.

To ensure your investments have the maximum time to grow, you should start investing from an early age. It's often seen that young investors lack money but they have plenty of time in their hands and in the case of older investors even if they have lots of money they lack the time.

So, no matter how little money you have to invest, start investing your money now so that you can enjoy the power of compounding and achieve your wealth creation goal.

3. The Power of Compounding

Compounding is one of the strongest tools which everyone must use to achieve their wealth creation goals. It's slow at first but as time passes it starts to show its actual magic. You will be surprised to see how fast your money grows.

As Einstein said ‘Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.’

The power of compounding is also used by the most famous investor of all times, Warren Buffett. He has built his entire fortune by understanding the power of compounding and you can start understanding it too.

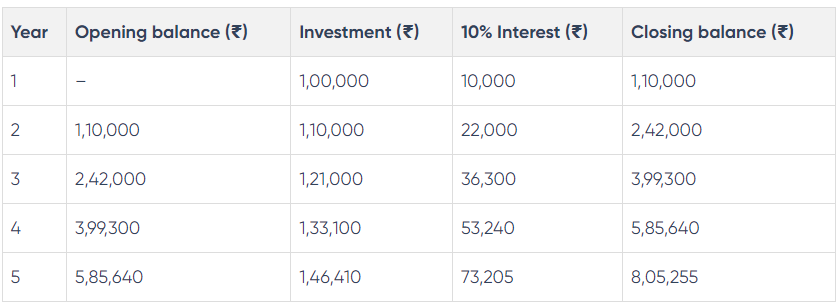

Example to help you understand how compounding works:

In the above table you will see investment is done for 5 years, ₹ 1 lakh is invested every year at a 10% annual interest rate.

Your investment return after 5 years will be ₹ 6,10,510, total amount after 5 years will be ₹ 8,05,255 and amount earned from interest ₹ 1,94,745

4. Never Spend More Than You Earn

If you are the person who spends more than you earn then you can never achieve your wealth creation goal. If you are spending more than your salary then you will only end up with lots of debt and make your life miserable.

Buying expensive phones, bags, watches, taking frequent vacations will make you look cool but won't add any value to your wealth creation journey. In fact, it will create problems in the long-term.

You may have seen people who are actually wealthy living a modest life. They don't waste money on unnecessary things and just focus on creating their wealth.

Don’t keep on buying things that are creating liabilities for you. Instead, buy things that become assets to you and which will help you to make your wealth creation journey easier.

The only way to live a debt free life is by spending less and saving more.

5. Comparing Your Goals With Others

We humans have the tendency to compare everything with others and this might be good in some aspects but comparing your savings with others is not a good idea.

Every person has a different salary, source of income, and their saving ability is also different. Comparing your savings with the other person, will only cause you stress and sadness. It will also reduce your ability to achieve your financial goals.

One way to be on track is by making a 5-year plan. This plan must include your goals, saving amount, time horizon, and how you are planning to reward yourself after achieving it.

6. Don’t Take Shortcuts

As an investor, you must make sure that you should not take shortcuts to achieve wealth creation.

Investing in mutual funds, ETFs, bonds, certificates, etc. takes a long time to show results but it's an effective and time-tested way of wealth creation.

Beyond this, there are a few shortcut methods that may look attractive at first but end up in disaster and in which you end up losing money. So, you must always be aware of scams related to investments and make sure not to get trapped.

That’s it in this article. Follow these points with discipline and dedication in order to achieve your wealth creation goal.

Visit our Knowledge Center for more articles on Mutual Funds. You can also find many valuable blogs in our Help and Support section regarding Samco Mutual Fund.

Related Article: Top 5 Reasons to Invest in Samco Flexi Cap Fund