Small Cap Funds – Benefits, Performance, and more

Most people avoid investing in small cap funds because they have a reputation of being extremely high-risk. But what people don’t realise is that most large and mid-cap companies started out as small cap companies. No company becomes a large-cap company overnight. They all start at the small-cap stage. This article will help you get a better perspective on small cap funds before you start investing in them.

In this article you will learn:

- What are Small Cap Funds?

- Benefits of Small Cap Funds

- Risks related with Small Cap Funds

- Taxation on Small Cap Funds

- Why Small Cap Funds Outperform in the Long Term?

- Things to Keep in Mind

- Who should invest in Small Cap Funds?

What are Small Cap Funds?

Small cap funds are mutual funds that must invest a minimum of 65% of funds in stocks of small cap companies as per the Securities and Exchange Board of India (SEBI) regulations. Small cap companies are those companies that are ranked from 251st in terms of market capitalization. Generally, these companies have a capitalization of less than Rs 5,000 crore.

Small cap companies are young and have huge potential to grow aggressively in the long term. But do note that small cap companies are more volatile and exposed to economic downturns. In small cap funds, investors must be invested for the long-term.

Benefits of Small Cap Funds

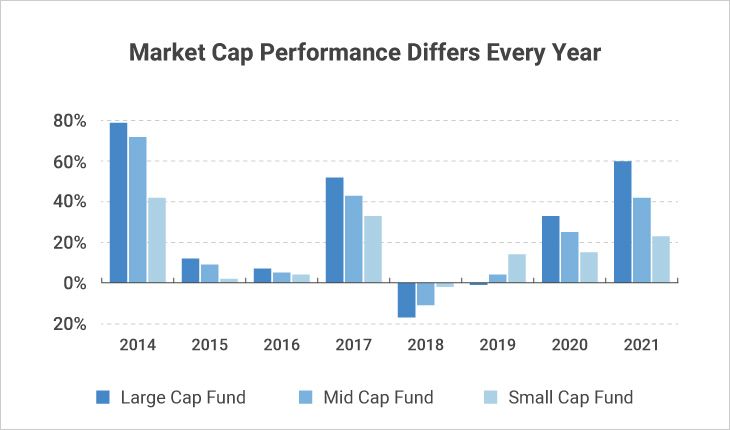

1. High potential for growth: Small cap funds invest in lesser-known start-up types of companies. These companies are still in the nascent stages. So, they have a huge potential for growth. It's often seen that most of the small cap funds have the ability to out-perform large cap companies. The graph below shoes the performance of small cap funds against large cap and mid cap funds since 2014.

2. Returns are rewarding: Investing in a small cap fund enhances your portfolio’s overall returns. But only if you stay invested for the long-term.

3. Discounted rates: There is a possibility that small-cap stocks are undervalued as these companies are new and unknown. Thus, they may be available at a discount.

Risks Associated with Small Cap Funds

- Small cap funds are inherently risky, resulting in sharp market ups and downs in the near term, making the portfolio highly volatile.

- Small cap funds carry very high risk which makes them suitable for only aggressive high-risk investors with a long-term investment horizon.

- Since all of the companies in small cap funds are growth stocks, they tend to hold on to all profits or reinvest them back into the business. As a result, small cap companies rarely pay dividends.

- Small cap companies have limited liquidity. This affects the ease with which the fund manager can buy and sell underlying stocks.

Taxation on Small Cap Funds

In small cap funds there are two types of taxation applicable.

Capital Gain Tax: Capital gain tax is charged on the profit you make during the tenure of the investment. The rate of tax is charged on the basis of how long you have been invested in the fund. Capital gains tax is further divided into -

- Short term capital gain is charged to investors who have a holding period of less than one year. The STCG on small cap funds is 15%.

- Long term capital gain is applicable to investors who have held the small cap funds for more than one year period. The LTCG on small cap funds is Nil, if the total LTCG is less than Rs one Lakh. LTCG on small cap funds exceeding Rs one lakh in a financial year is taxed at 10% plus any applicable cess.

Why Small Cap Funds Outperform in the Long Term?

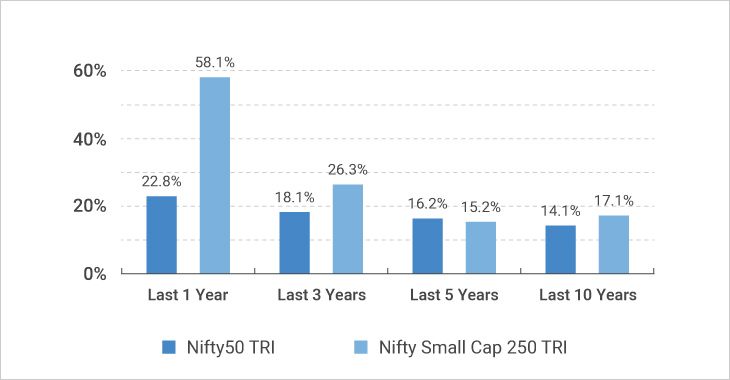

Historically, small cap stocks have outperformed large cap stocks in the long run. But why does this happen? The below chart will help us get a better understanding of the reason behind the success of small cap funds.

Here are the reasons why small cap funds show excellent results in long term:

- Small cap companies are typically less capital intensive, allowing them to produce higher Return on Equity (ROEs). In the long run, small cap companies with greater ROEs result in providing better returns to investors.

- Most of the small cap stocks are under-researched and fund managers identify those stocks and get them at discounted rates. These stocks are considered to be alpha stocks.

- Small cap has a broader range of opportunities for the investors compared to the mid and large caps in the long term. Therefore you will find 250 small caps stocks in the Nifty 500 and only 150 mid cap stocks and 100 large cap stocks.

- Small caps perform amazingly during the time of restoration. For example, the small cap stocks have rallied post Covid situation.

Things to Keep in Mind While Investing in Small Cap Stocks

1. Net Asset Value (NAV)

NAV of small cap funds is very sensitive to the underlying benchmark and when the market is not doing great, small cap funds suffer the most. This is considered to be the best time to invest if you have a long-term horizon and high risk appetite.

2. Low Expense Ratio

Expense ratio is charged for managing and operating a mutual fund. It is paid from the fund’s NAV irrespective of whether the unitholder has made a profit or a loss. SEBI has mandated that fund houses can charge a maximum expense ratio of 2.50%. As you know the expense is deducted from your fund NAV. This means you have to make sure that the expense ratio is low for whichever small cap fund you are going to invest your money in.

3. Risk Adjusted Return

Small cap funds are very volatile and have risks. But there are some small cap funds which are excellent in managing risks compared to its peers in the market. You can identify the funds with great risk-adjusted returns with the help of Sharpe ratio, Sorting ratio, etc.

4. Time Horizon

Investing in a small cap fund should be done with a long-term investment strategy in mind. Your ideal time horizon should be seven to ten years.

5. Expertise of Fund Manager

Fund manager expertise, knowledge of the market, and research play an important role in the performance of your portfolio over time. While selecting a small cap fund you should look at the past performance of the fund manager, especially during market ups and downs.

Who should invest in Small Cap Funds?

Small cap funds have only one goal - To produce high long-term returns. In comparison to mid cap and large cap funds, small cap funds have a high return-risk ratio and experiences high levels of volatility.

After learning about the benefits and risks associated with small cap funds, you can begin investing in these funds. But only if you have the risk taking capacity and can invest for the long term. This is everything that you must know about small cap funds before you start investing. Make sure that you do proper homework from your end and then start your investment.

Visit our Knowledge Center for more articles on Mutual Funds. You can also find many valuable blogs in our Help and Support section regarding Samco Mutual Fund.