In this article, we will show you how to invest in Samco Flexi Cap Fund.

There are two options available for the investments:

- Lump-sum (Min of Rs 5,000/- and in multiples of Rs 1/- thereafter)

- Systematic Investment Plan (SIP) (Minimum investment of Rs 500/- and in multiples of Re 1/- thereafter)

Let us start by investing in SIP mode:

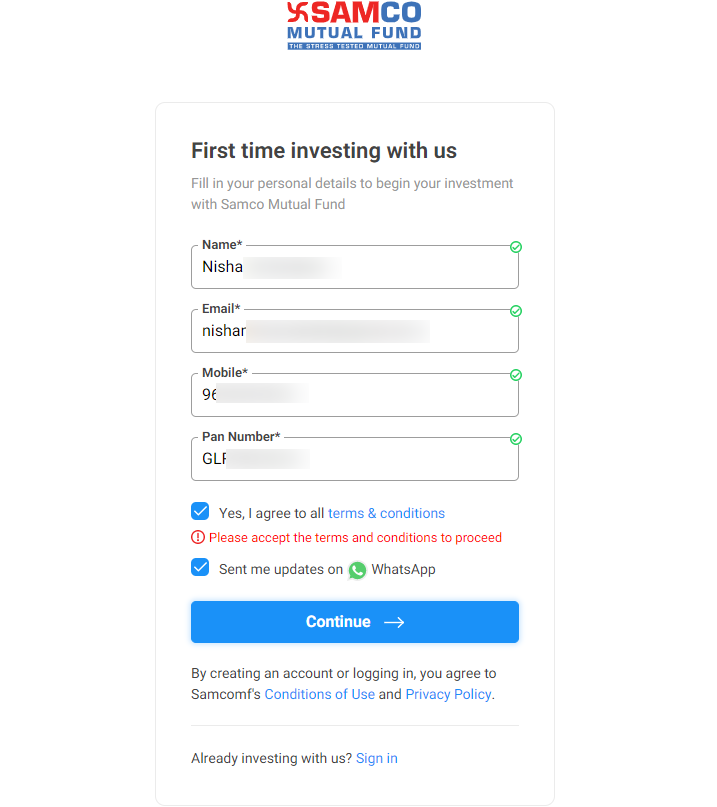

Step 1: Visit samcomf.com and click on new investor

Step 2: Registration

- Enter the mandatory details for registration such as name, email id, mobile number, and Permanent Account Number (PAN). You can also tick on the checkbox to receive updates on WhatsApp.

- Now click on 'Yes, I agree to all the terms and continue with the process.

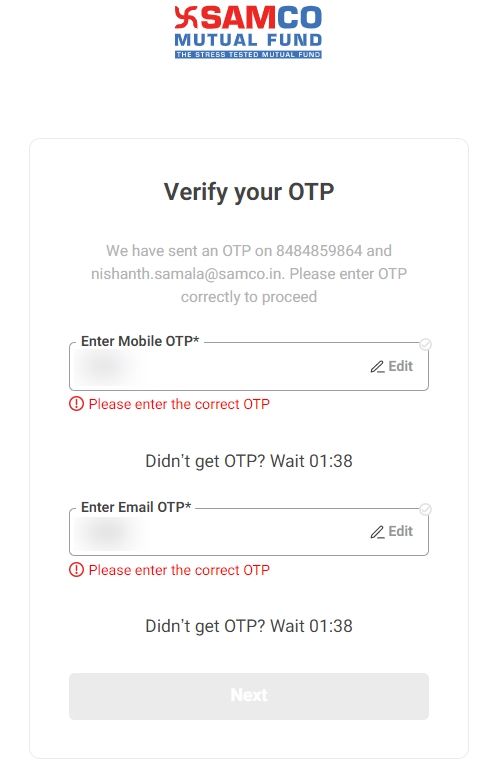

Step 3: Verify your contact details

- Now verify your contact details with a one-time password (OTP). If you don’t receive the OTP, you can re-generate it again after the two-minute timer.

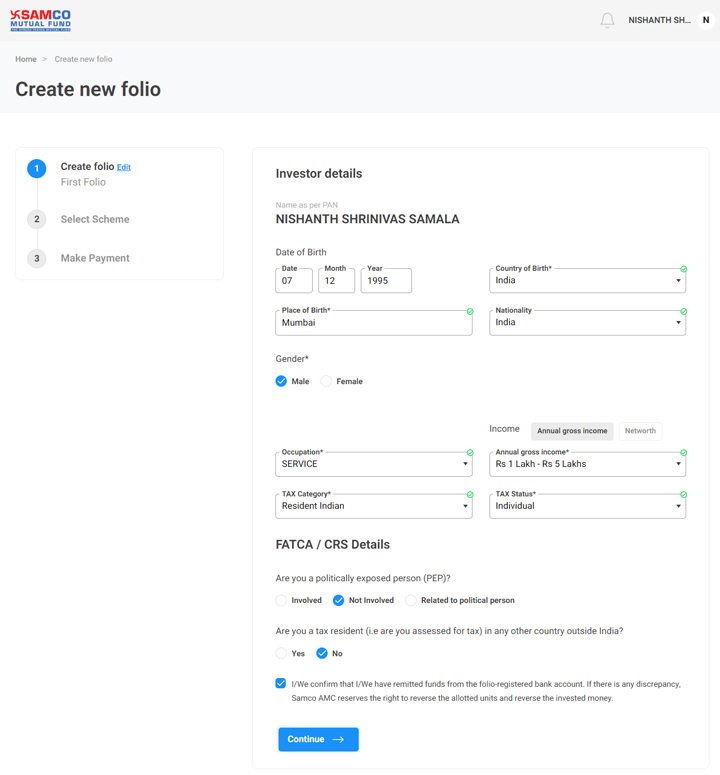

Step 4: Investor details

- When you click next after OTP verification, you will see your name auto-fetched as per your PAN.

- Now fill in additional details such as date of birth, place, country, nationality, and gender.

- After scrolling down, add your occupation, income, choose tax category and status.

- Fill in FATCA / CRS details and tick the checkbox to proceed further.

- Click on continue.

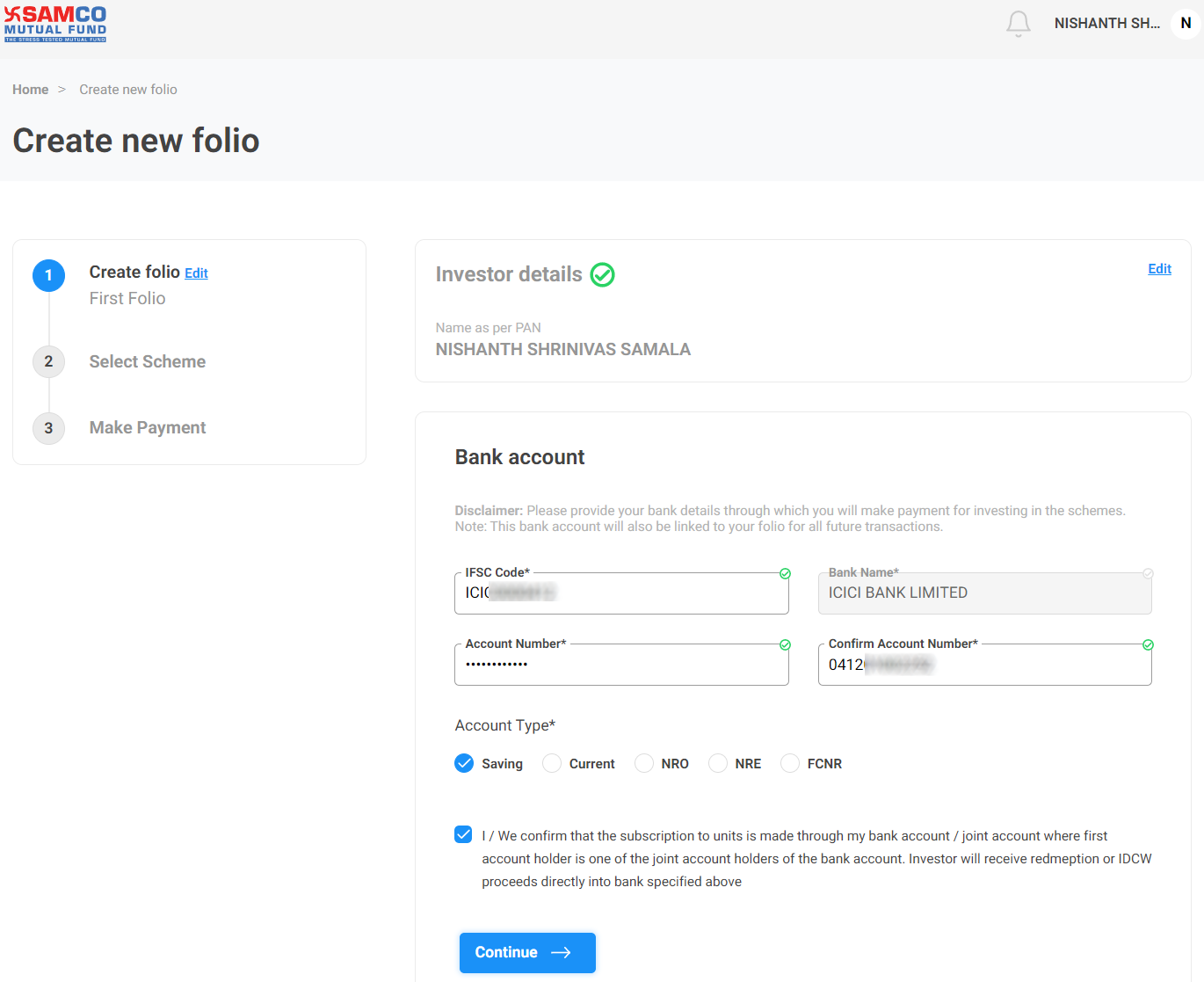

(Gentle Reminder: To add your bank account details, we suggest you keep your bank passbook handy in order to save your time)

Step 5: Add your bank account details

- Your bank account detail will be linked to your folio for further investments.

- Add IFSC code, Bank name will be auto-fetched once you enter your IFSC code.

- Now add your account number and confirm it again.

- Choose your account type and tick the check box to confirm the details

- Now click on continue.

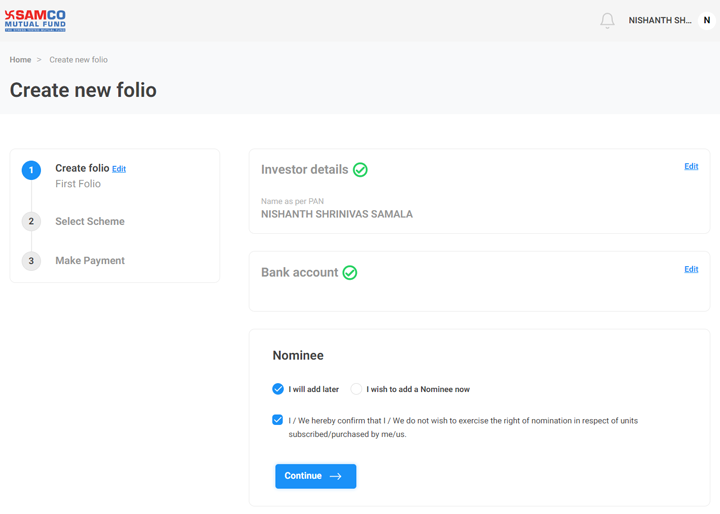

Step 6: Add your Nominee: (You can choose to add your nominee later)

- In case you want to add your nominee, follow the below-mentioned steps:

- Enter the nominee details such as name, relationship, the share of allocation in percentage, and date of birth. (Note: You can add up to 3 nominees)

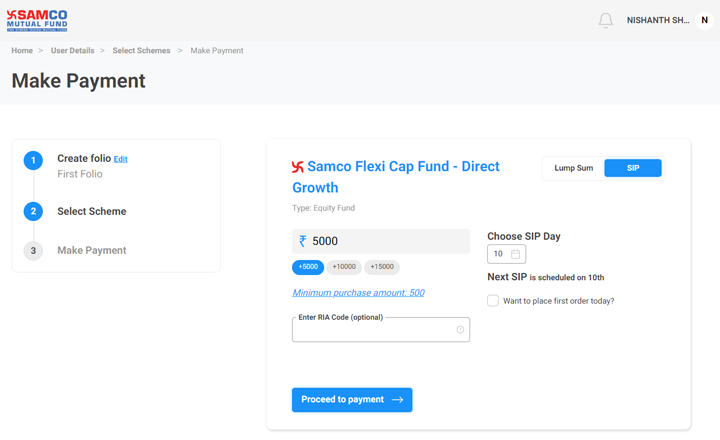

Step 7: Select your investment plan as SIP

- You will see the dashboard displaying the name of Fund - Samco Flexi Cap Fund - Direct-Growth.

- Enter the amount you want to invest every month such as a minimum of Rs 500/- or more.

- Select the SIP day from the calendar, you will see the next SIP date below the calendar.

- If you have any RIA code (Registered Investment Advisor), you can add their code in the box. (optional)

- Now click on proceed to payment

Step 8: Make payment

- Now verify your order details and make payment

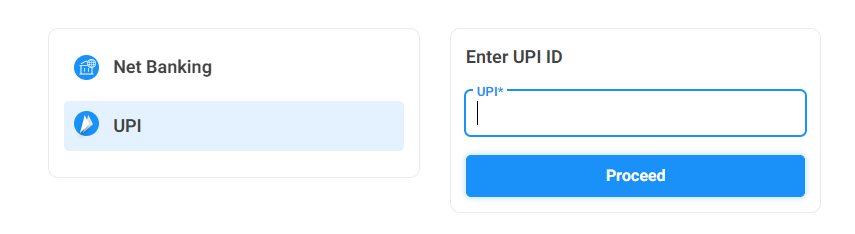

- You have two options to complete the investment through net banking and UPI

- Net banking will take you to your bank portal to log in and initiate the payment. OR you can simply add your UPI id and click on proceed

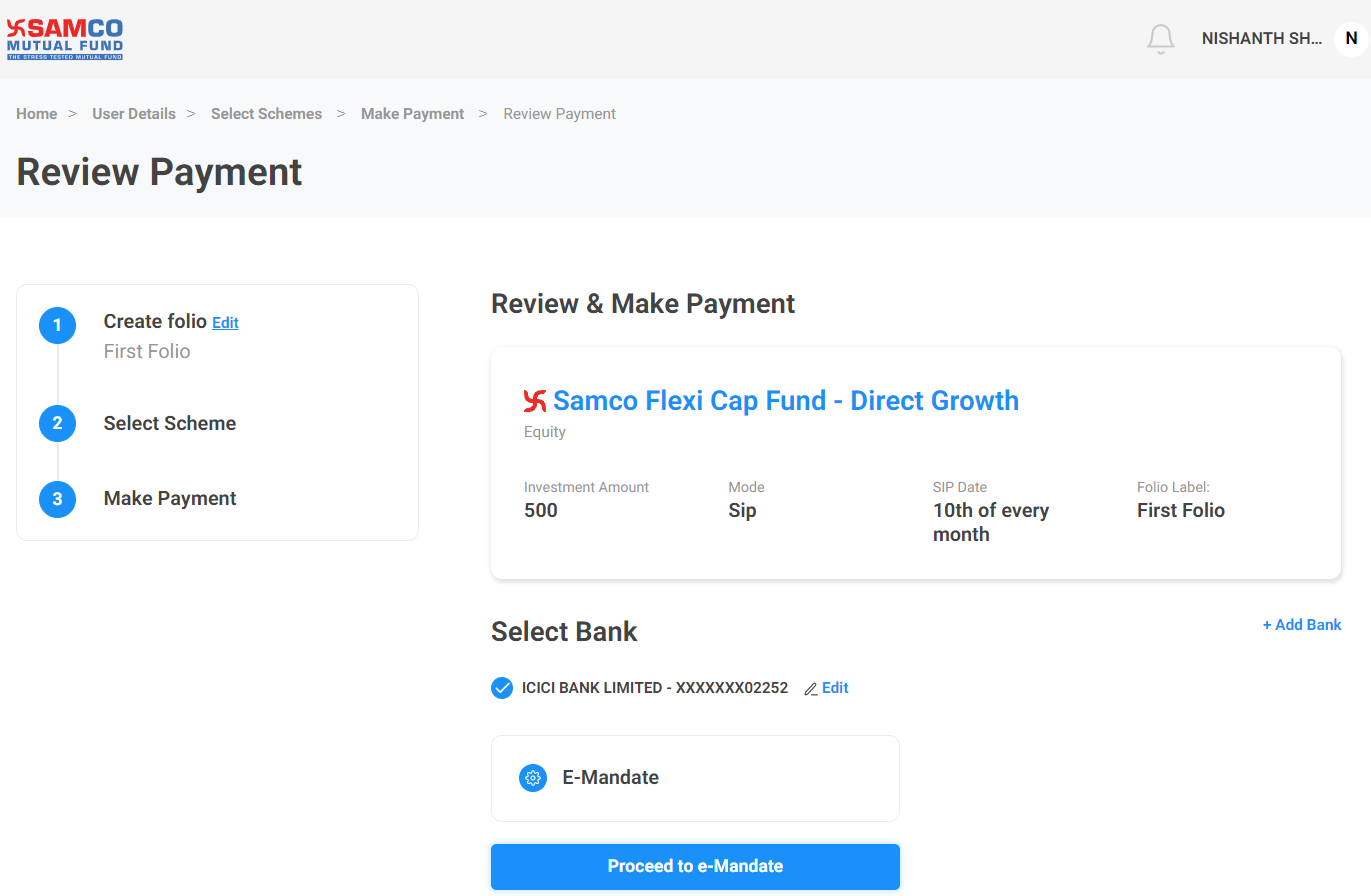

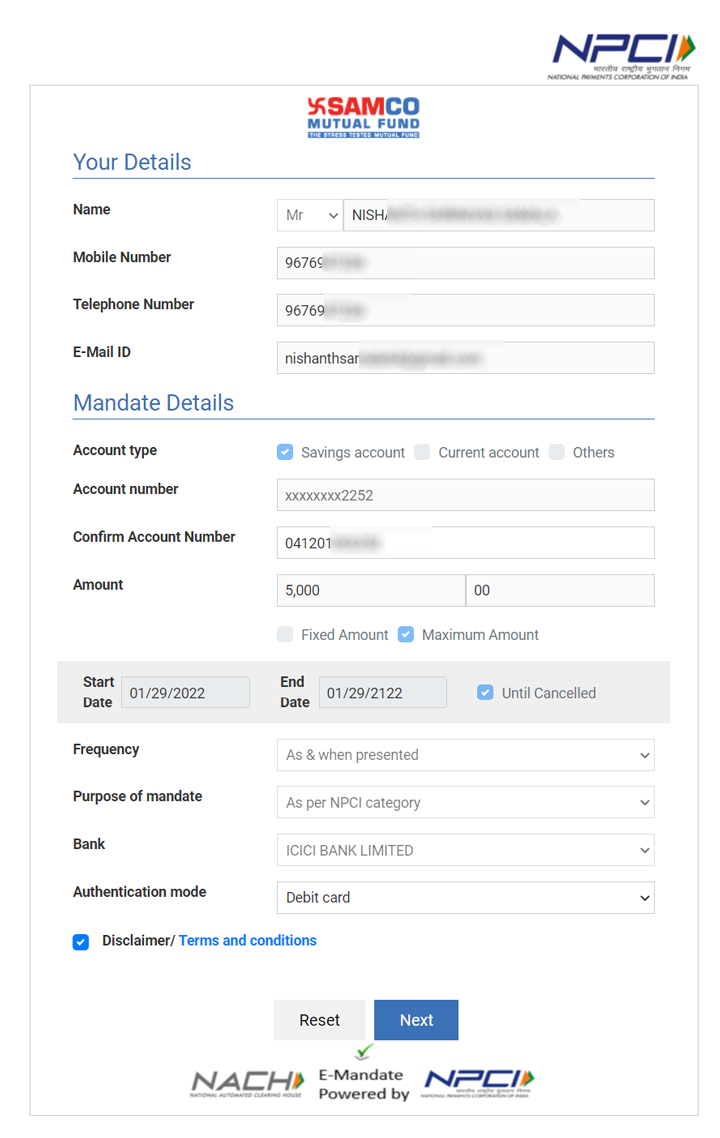

Step 9: Proceed to E-mandate

- Now complete your E-mandate form (NACH Form) - Fill and verify your details properly and proceed with it.

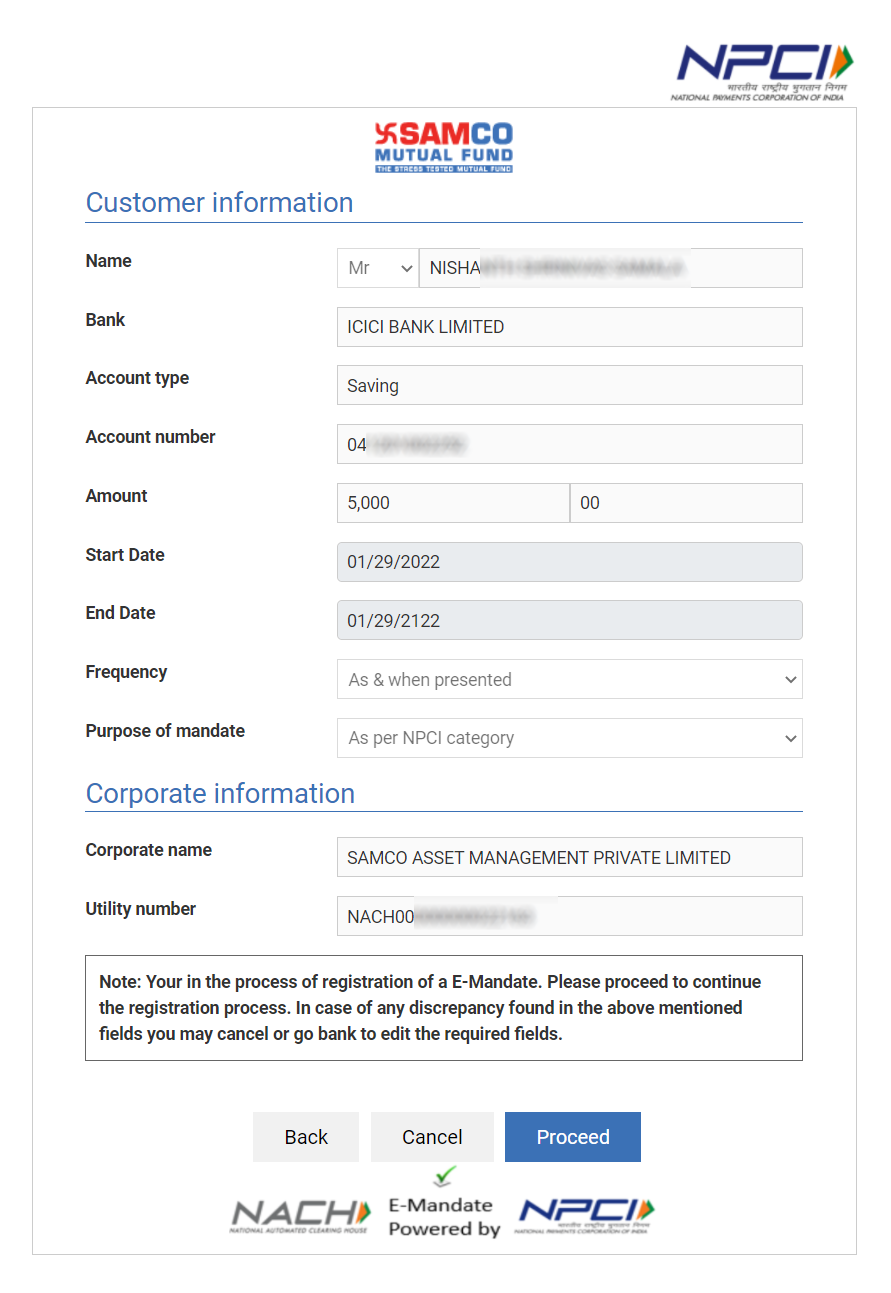

Step 10: Verify the policy details

- Once you submit your NACH form successfully. You will see your details such as Investment amount, Fund mode, Folio number, order number, and payment reference number on the screen.

Watch the video to know how to invest in Samco Flexi Cap Fund

This is how you can easily invest in Samco Flexi Cap Fund. For more information about investing in mutual funds, visit www.samcomf.com.

Visit our Help and Support for more articles on Samco Mutual Fund's you can also find many valuable blogs in our Knowledge Center section.