Source: NGen, as on September 30, 2022

Higher risks and volatility which can efficiently be managed due to a 3-year lock-in

Higher risks and volatility which can efficiently be managed due to a 3-year lock-in

|

NFO Period

|

November 15, 2022 to December 16, 2022

|

||||||||||||||||

|

Type of scheme

|

An Open-ended Equity Linked Saving Scheme with a statutory lock-in of 3 years and tax benefit

|

||||||||||||||||

|

Investment Objective

|

The investment objective of the scheme is to generate long-term capital appreciation through investments made predominantly in equity and equity related instruments. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

|

||||||||||||||||

|

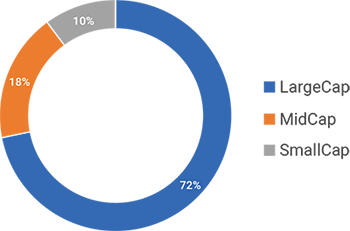

Asset Allocation Pattern

|

Equity related instruments shall mean equities, cumulative convertible preference shares and fully convertible debentures and bonds of companies. Investment may also be made in partly convertible issues of debentures and bonds including those issued on rights basis subject to the condition that, as far as possible, the non-convertible portion of the debentures so acquired or subscribed, shall be disinvested within a period of 12 (twelve) months. All investments by the Scheme in equity shares and equity related instruments shall only be made provided such securities are listed or to be listed.

|

||||||||||||||||

|

Benchmark Index

|

Nifty 500 Index TRI

|

||||||||||||||||

|

Minimum Application Amount

|

₹ 500 and in multiples of ₹ 500/- thereafter

|

||||||||||||||||

|

Entry Load

|

Not Applicable

|

||||||||||||||||

|

Exit Load

|

Nil

|

||||||||||||||||

|

Fund Manager

|

Ms.Nirali BhansaliFund Manager - Equity |

||||||||||||||||

Welcome to www.samcomf.com, the website of Samco Asset Management. Please read this information carefully. Access to this website is confirmation that you understand and agree to be bound by all of these Terms and Conditions.

The information and data contained in this Website do not constitute distribution, an offer to buy or sell or solicitation of an offer to buy or sell any Schemes/Units of Samco Mutual Fund in any jurisdiction in which such distribution, sale or offer is not authorised. The material/information provided on this website is for the limited purposes of information only for the investors. Read more

|

|

|